Since the launch of my Youtube Chanel in lately 2022, I didn’t stop receiving tons of emails and messages from people asking for my expertise and my guidance to help them establish a business online, and in most of time, I always recommend creating an eCommerce business, and in rarest cases, creating a blog or a community, it’s all based on each one experience and budget.

In today’s article, I will show you the right path to follow in order to buy and sell sites and business online, and which is one of the most effective ways to make money online that some big billionaires like Warren Buffet used to do in his carrier — and still using it I think —, so let’s get started !

Who is Warren Buffet ?

Before dinging into the details about how to buy and sell sites online, let me introduce to you first who is Warren Buffer so you can get inspired, and you may probably chose this method to make money online.

Warren Buffett is one of the most successful investors in history. He has amassed a fortune of over $100 billion by following a simple investment strategy: buy good companies at a fair price and hold on to them for the long term.

Buffett’s investment philosophy is based on the work of Benjamin Graham, a professor at Columbia University who wrote the seminal book The Intelligent Investor. Graham argued that investors should focus on buying stocks that are trading below their intrinsic value, or what the company is actually worth. He also stressed the importance of diversification, or spreading your money across different types of investments.

Here are some of the key principles of Buffett’s investment strategy:

- Buy good companies at a fair price. Buffett looks for companies that have strong competitive advantages, such as a unique product or service, a loyal customer base, or a strong management team. He also looks for companies that are trading below their intrinsic value.

- Hold on to your investments for the long term. Buffett believes that the best way to build wealth is to invest for the long term. He has held many of his investments for decades, and he has reaped the rewards of compounding interest.

- Diversify your portfolio. Buffett believes that it is important to diversify your portfolio by investing in a variety of different asset classes, such as stocks, bonds, and real estate. This helps to reduce your risk and maximize your returns.

- Buffett’s investment strategy has been incredibly successful, and it has made him one of the richest people in the world. If you want to follow in his footsteps, you should focus on buying good companies at a fair price, holding on to your investments for the long term, and diversifying your portfolio.

Top Tips to look for when searching for a business to buy

Here are some top tips to look for when searching for a business to buy:

- Do your research. This is the most important step in buying a business. You need to understand the industry, the market, and the competition. You also need to understand the financials of the business and how it has performed in the past.

- Find a business that you are passionate about. If you are not passionate about the business, it will be very difficult to succeed. You need to be able to wake up every day and be excited about what you are doing.

- Get professional help. Buying a business is a complex process. It is important to get professional help from an accountant, a lawyer, and a business broker. They can help you avoid costly mistakes and make sure that you are getting a good deal.

- Be prepared to negotiate. The asking price is just a starting point. Be prepared to negotiate with the seller to get the best possible price.

- Don’t be afraid to walk away. If you are not comfortable with the deal, don’t be afraid to walk away. There are plenty of other businesses out there.

Where can I safely buy/sell a site or business online ?

There are many marketplaces online that offer a buy and sell services for sites, blogs, apps, software and businesses, before signup to any marketplace, use your indulgence and search for that marketplace reputation and reviews left by its users.

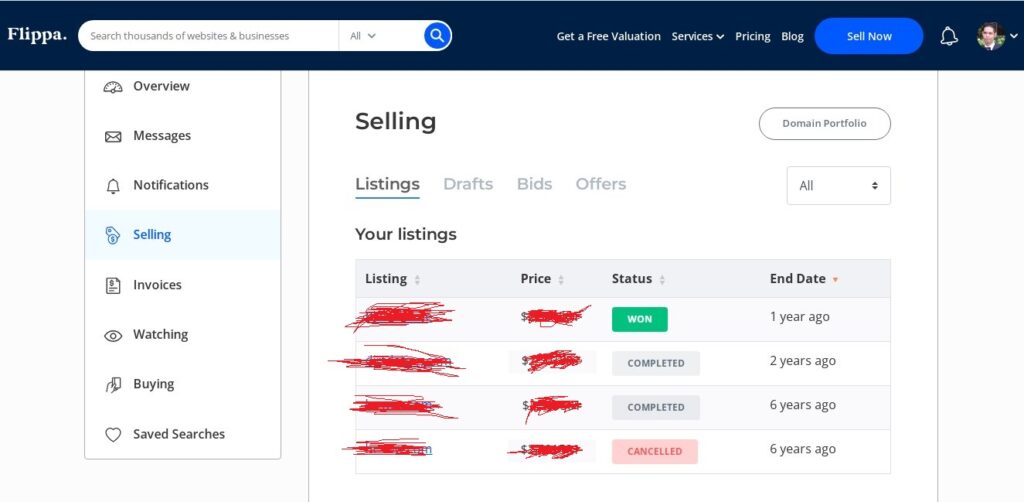

I used many marketplaces in the past to buy/sell sites, but the one I liked the most is Flippa, not only because of their reasonable pricing, but also because of the ease of use of ownership transfer once the sale is made, and also because of the money transfer steps which both secure the buyer and the seller, for this they have partnered up with escrow.com which is the world’s most secure payment method from a counterparty risk perspective – safeguarding both buyer and seller.

The screenshot above is my seller/buyer dashboard where it shows the history of transaction I made in the last years.

Sell on Flippa

If you want to sell your business through Flippa, use their free assessment tool right on their website. With this information at your fingertips, you can then choose to market your business on your own or sign up with a broker. Listing your asset on Flippa only takes 15 minutes and you will be connected with potential buyers immediately. Here are top things you can sell on Flippa :

- Affiliate websites

- Blogs

- eCommerce stores

- SaaS businesses

- Applications

- Digital products

- Software

How does the assessment work?

It’s as easy as navigating to their website and engaging in a conversation with Flippale’s valuation bot. Flippa has access to the largest marketplace for buying and selling businesses online and has more historical sales data than anyone on the web. Therefore, the valuation you receive is a good indication of the price you could achieve for your asset.

But how exactly does Flippa determine the price of a business? For this, Flippa considers the following essential factors:

Business seniority

Businesses are considered less risky if they are more than two years old. Namely, because they are easier to assess as historical monetization trends become evident. And with 90% of e-commerce startups failing within the first 120 days, it makes sense that age is an important consideration.

Financial Performance

Like all other digital assets, e-commerce businesses are valued based on their financial performance. Specifically, their sell-through rates and net profits. Buyers will also consider this as an important factor when negotiating the price.

Repeat orders

Sites that have a healthy database of regular readers, users, and/or buyers are more valuable than those that are entirely advertising-driven or only attract one-time transactions. In other words, if you’re selling a loyal following with your business, that speaks volumes about its value.

Growth trends

Growth trends help predict the performance of a business based on its growth and stability so far. Sites that are stable and can demonstrate predictable growth are most preferred.

However, this can be a difficult factor to measure. Small business success spikes, for example, are often difficult to sustain. Buyers will consider an average for businesses of this nature.

E-commerce companies in decline in terms of growth may also be penalized from a valuation perspective.

Find a broker

Once you’ve completed your business valuation, take the stress out of selling by letting Flippa find you a broker. This is recommended for sellers who don’t have much time or don’t know where to start.

A professional broker knows how to present your business in the best light, which is imperative to maximizing the sale price you can hope to achieve.

Flippa partners with 45 brokers located in different parts of the world, specializing in various business types and price ranges. You can work with brokers based in Lithuania, Singapore, Austria, Sweden, Australia, UK, Thailand and USA.

Buy on Flippa

For buyers, Flippa also offers a search service that helps you identify qualified businesses. You can request a detailed report to get a better overview of these companies. With this information at your fingertips, you are cleared to make your purchase with your eyes wide open.

Flippa Finder – Identify your first investment

If you’re a first-time marketer looking to buy a profitable online business, you may not know where to start. This is where Flippa’s Finder Service comes in. It’s a concierge service that offers new buyers a personalized consultation to assess their experience and acquisition criteria.

The consultation lasts one hour and comes with an initial set of ads to review. These will be tailored to your tenure and provide you with the pros and cons of each transaction. You will also receive a follow-up review once you find something to buy. Flippa’s consultants then help you analyze the deal and think through the decision, so you can better navigate your offer.

Tips for making money buying and selling businesses online

Here are some tips for making money by buying and selling businesses online:

- Be patient. It takes time to find a good deal and to fix up a business. Don’t expect to get rich quick.

- Be prepared to work hard. Buying and selling businesses is a lot of work. You need to be prepared to put in the time and effort.

- Be knowledgeable. You need to be knowledgeable about the business world and about the industry you’re investing in.

- Be careful. There are a lot of scams out there. Be careful not to get taken advantage of.

If you’re willing to put in the work, buying and selling businesses can be a great way to make money online.

Final Thoughts

Buy and sell businesses online remains one of the best ways to make money online, and Flippa could be a game changer when it comes to making money for a business you no longer want to run or presenting you with a huge investment opportunity.

It is a large market with extensive protections in place that allow sellers and buyers to proceed well informed. Guaranteed to beat any platform or broker on success fees, Flippa is one of the best online marketplaces to buy or sell a business.

Let me know your toughts in the comment box below; I would love to hear from you!

Warren Buffet was a goat, I would believe buying a business, scaling it and reselling is one of the most profitable businesses